Best Buy Credit Card: Tech Treasure Chest or Plastic Pitfall?

Best Buy credit card can be a shimmering lure, promising a bounty of rewards and financing options. But before you wield this plastic lightsaber like a Jedi master, let's delve into its depths to see if it's truly the droid you're looking for.

Best Buy Credit Card Reward Rundown

- 5% Back on Best Buy: Fuel your gadget obsession with a constant stream of 5% back in rewards on every tech treasure you hunt down at Best Buy. That's a whopping 2.5 points per dollar spent, redeemable for gift certificates, travel, cool merchandise, or statement credits. Think gleaming gaming PCs, sleek smartphones, and noise-cancelling headphones – all at a delightful discount!

- Bonus Blast: New cardholders, prepare for hyperdrive speed! Get a 10% back bonus on your first day's purchases within 14 days of opening the card. Double the reward power, young Padawan!

- Beyond Best Buy: Don't limit your rewards to just tech. Score 5% back on gas and groceries for the first $6,000 spent each year, then 1% after. Keep your car fueled and your fridge stocked while racking up points. Imagine filling your fuel tank and pantry, all while earning rewards for your next gadget spree.

Financing Force: Power Up Your Purchases

- 0% APR: Need to spread the cost of that state-of-the-art TV? Unleash the 0% APR financing for up to 24 months on select major purchases. Just remember, pay it off before the interest kicks in like a glitching droid.

- Extended Warranties: Breathe easy knowing your tech investments are protected. Get extended warranties on most Best Buy purchases, adding a layer of security to your gadgets. It's like a force field for your electronics!

The Shadow Side: Beware the Dark Side of Plastic

- Annual Fee: Standard cardholders face a $59 annual fee, while the premium My Best Buy® Credit Card boasts a $199 fee but comes with additional perks like extended returns and early access to sales. Weigh the rewards against the cost before committing. Remember, every credit card has its kryptonite, so choose wisely.

- High Interest: The regular APR for purchases outside the promotional period is a hefty 17.99% - 25.99%. Miss payments, and you'll be singing the Wookiee blues of debt. Responsible spending is the true path to financial serenity.

- Temptation's Trap: Easy financing can be a seductive siren song, leading to impulse purchases. Remember, a balanced budget is your ultimate Jedi power. Don't let shiny gadgets cloud your financial judgment!

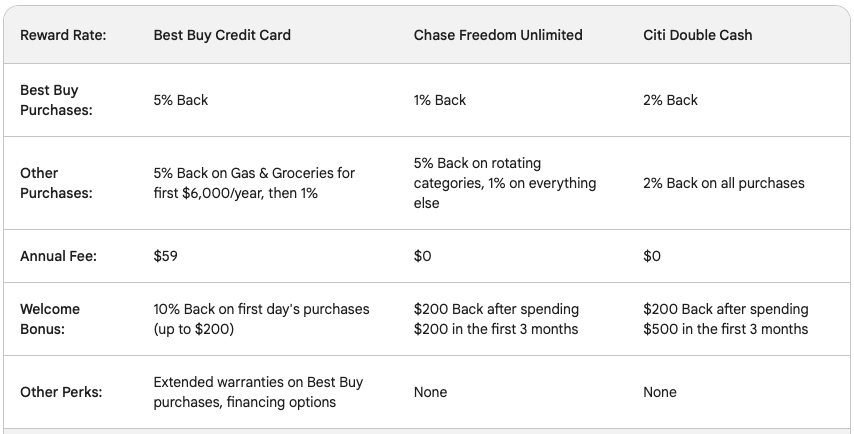

Best Buy Credit Card vs. Cash Back Kings: Is 5% Enough for Tech Fanatics?

The siren song of tech beckons, but should you answer with the Best Buy credit card's 5% back or the dazzling promises of cash back kings like Chase Freedom Unlimited or Citi Double Cash? Let's unpack the rewards battle royale for tech enthusiasts and see who reigns supreme.

5% Back: Tech Treasure Trove or Limited Loot?

- For the Gadget Guru: For those who live and breathe tech, Best Buy's 5% back on all purchases is like a bottomless pit of upgrade points. Every drone, smartphone, and VR headset fuels your reward pool, making that dream gaming PC one swipe closer.

- Beyond the Blue Oval: While Best Buy is your reward playground, the 5% back extends to gas and groceries for the first $6,000 spent each year. Techie, meet practicality!

Cash Back Kings: Flexibility or Focused Firepower?

- Universal Appeal: Cards like Chase Freedom Unlimited offer a flat 5% back on rotating categories and 1% on everything else. This flexibility is a boon for diverse spenders who don't always raid Best Buy.

- Double the Dip: Citi Double Cash doubles down with 2% back on all purchases, essentially turning every swipe into a mini-reward. It's not tech-specific, but every penny counts towards your next gadget splurge.

It's a lightsaber duel between focused firepower and all-around flexibility. Here's your cheat sheet:

- Tech Fanatic: If Best Buy is your Mecca, the 5% back is a no-brainer. Plus, the gas and grocery bonus adds everyday value.

- Diverse Spender: If you roam beyond the tech aisles, consider the flexibility of Chase Freedom Unlimited or the consistent rewards of Citi Double Cash.

Remember, the best card is the one that aligns with your spending habits. If you're a dedicated techie, the Best Buy credit card is a powerful tool for fueling your obsession. But for those who value versatility, the cash back kings might offer a broader rewards landscape.

5 Ways the Best Buy Credit Card Fuels Your Gadget Obsession

Tech enthusiasts, prepare to level up your gadget hoarding with the Best Buy credit card: a portal to sweet rewards and financing options that will have your tech dopamine levels skyrocketing. But before you unleash your inner Jedi master and start swiping like a lightsaber, let's explore how this card can supercharge your tech obsession—responsibly, of course!

- Points Galore for Gadget Glory: Every tech treasure you hunt down at Best Buy becomes a bounty of reward points. Feast on a 5% back in rewards on all purchases, translating to sweet discounts on your next gaming PC, noise-cancelling headphones, or that sleek new smartphone. Imagine, every drone, smart speaker, and VR headset contributing to your reward pool!

- Bonus Blast for New Padawans: New cardholders, prepare for hyperspace speed! Get a 10% back bonus on your first day's purchases within 14 days of opening the card. Double the reward power, young Padawan! This jumpstart lets you fuel your initial gadget cravings while racking up points for future tech treasures.

- Beyond Best Buy: Expanding Your Reward Galaxy: Don't limit your rewards to gadgets. This card extends its bounty to everyday essentials like gas and groceries, offering 5% back for the first $6,000 spent each year. Keep your car fueled and your fridge stocked while simultaneously earning points for that next tech splurge. It's like a win-win for your tech obsession and your everyday needs!

- Financing Force: Power Up Your Purchases: Need to spread the cost of that galaxy-grade gaming PC? Unleash the 0% APR financing for up to 24 months on select major purchases. Just remember, pay it off before the interest kicks in like a malfunctioning protocol droid. Responsible financing lets you snag your dream gadgets without feeling the financial Force pinch.

- Extended Warranties: Breathe Easy, Tech Warriors: Gadgets can be fickle allies. But with the Best Buy credit card, you get extended warranties on most purchases, adding a layer of protection to your tech investments. Imagine, your trusty drone crashing? No worries, your extended warranty has your back! This peace of mind lets you enjoy your gadgets without the fear of costly repairs.

Tips for Smart Spending with the Best Buy Credit Card

The Best Buy credit card: a treasure trove of rewards and financing options for tech enthusiasts. But like any powerful tool, it requires careful handling. So, before you unleash your inner Jedi master and start swiping like a lightsaber, master these smart spending tips to ensure your tech obsession doesn't morph into a financial nightmare:

- Budget is Your Lightsaber: Don't let impulse buys cloud your judgment. Create a realistic budget and stick to it. Remember, the 5% back isn't worth overspending and drowning in debt.

- Track Your Points, Master Your Force: Download the Best Buy app and track your rewards diligently. This helps you plan purchases strategically and maximize your point-earning potential.

- 0% APR is a Jedi Mind Trick, Not a Permanent Solution: Yes, 0% APR on select purchases is tempting, but remember, it's temporary. Pay off your balance before the promotional period ends, or you'll face the wrath of high interest rates.

- Avoid the Dark Side of Annual Fees: The standard card has a $59 annual fee. Weigh the benefits against the cost and consider alternative cards if rewards don't justify the yearly expense.

- Resist the Siren Song of Easy Financing: Don't let easy financing lure you into buying gadgets you don't truly need. Remember, responsible credit use is the ultimate Jedi skill.

- Extended Warranty: Don't Overpay for Peace of Mind: Consider manufacturer warranties and third-party options before opting for the extended warranty on every purchase. Evaluate the cost-effectiveness based on the gadget's value and potential repair costs.

- Redeem Wisely, Young Padawan: Don't let reward points gather dust. Redeem them for gift cards, travel, or merchandise that aligns with your budget and needs.

- Pay More Than the Minimum: Resist the minimum payment trap. Increase your monthly payments to pay off your balance faster and avoid accumulating hefty interest.

- Remember, You Are Not Alone: The Best Buy website offers budgeting tools and financial resources. Utilize them to stay on track and avoid overspending.

- Review and Reflect: Regularly review your spending and credit card statements. Learn from your past purchases and adjust your habits for a healthier financial future.

By following these tips, you can transform the Best Buy credit card into a powerful tool for fueling your tech obsession without becoming a debt Padawan. Remember, responsible spending is the true path to financial serenity, and with knowledge as your lightsaber, you can conquer the galaxy of electronics deals wisely.

The Verdict: To Swipe or Not to Swipe?

The Best Buy credit card is a powerful tool for tech enthusiasts who are frequent shoppers and prioritize rewards. However, like any powerful tool, it requires caution. Be wary of the annual fees and high interest rates. If you're a disciplined spender who can pay off balances quickly, it can be a rewarding companion on your tech adventures. Just remember, with great power comes great responsibility (and budget planning).

Frequently Asked Questions

The Best Buy Credit Card offers exclusive benefits, including special financing options, rewards points on eligible purchases, and access to exclusive financing offers.

To apply for a Best Buy Credit Card, visit their website or a store. Eligibility criteria typically include a valid ID, a social security number, and meeting the credit requirements.

The Best Buy Credit Card can only be used at Best Buy, while the Best Buy Visa Card can be used anywhere Visa is accepted. Both cards, however, offer similar rewards and financing options for Best Buy purchases.

The Best Buy Credit Card may have annual fees depending on the type of card and your creditworthiness. Check the terms and conditions for the specific details related to fees.

With the Best Buy Credit Card, you earn rewards points on eligible purchases, which can be redeemed for Best Buy certificates. The rewards program often includes special promotions and bonus point opportunities.

Yes, you can manage your Best Buy Credit Card account online through the Best Buy website. This includes checking your balance, making payments, and viewing transaction history.

The Best Buy Credit Card often offers special financing options, such as no-interest financing for a specified period on qualifying purchases. Details may vary, so check the current promotions for more information.

Best Buy Credit Card typically provides a grace period for payments. It's essential to make payments on time to avoid late fees and maintain the benefits of the card.

Yes, the Best Buy Credit Card can be used for both in-store and online purchases at Best Buy. Ensure that your account information is up-to-date for a seamless online shopping experience.

Best Buy employs security measures, including encryption and fraud monitoring, to safeguard the information of Best Buy Credit Card users. Additionally, users can set up account alerts for added security.

Leave a Reply