Payday Loans EloanWarehouse: Accessible, Reliable, and Swift Financial Assistance

Payday loans EloanWarehouse offers a lifeline to individuals facing sudden financial emergencies or cash shortages between paychecks. As a leading player in the payday lending industry, EloanWarehouse provides swift and accessible financial solutions to those in need. With their streamlined application process and quick approval times, EloanWarehouse stands out as a reliable option for obtaining immediate funds. However, before availing oneself of these loans, it's essential to understand both the benefits and drawbacks they entail.

What is eLoanWarehouse?

eLoanWarehouse is an online lender specializing in installment loans for borrowers with less-than-perfect credit. Unlike payday loans, which are typically due on your next payday, eLoanWarehouse's loans have longer repayment terms (6 to 12 months) and lower APRs (though still higher than traditional bank loans). This makes them potentially more manageable, especially if you need a larger loan amount (up to $2500).

Why Choose EloanWarehouse for Your Payday Loan Needs?

Choosing EloanWarehouse for your payday loan needs offers several distinct advantages that set it apart from other lenders in the market. Here are compelling reasons why EloanWarehouse stands out as a preferred choice:

- Speed and Efficiency: EloanWarehouse is renowned for its swift and efficient loan processing. When faced with a financial emergency, time is of the essence, and EloanWarehouse understands this urgency. Their streamlined application process ensures that borrowers can receive approval and access funds quickly, often within 24 hours of applying.

- Accessibility: EloanWarehouse prides itself on being inclusive and accessible to individuals from all financial backgrounds. Unlike traditional banks that often have stringent credit requirements, EloanWarehouse considers various factors beyond just credit scores when evaluating loan applications. This means that even individuals with less-than-perfect credit histories may still qualify for a payday loan from EloanWarehouse.

- Flexible Repayment Options: EloanWarehouse recognizes that every borrower's financial situation is unique. To accommodate diverse needs, they offer flexible repayment options. Borrowers have the flexibility to customize their repayment schedule based on their financial capabilities, making it easier to manage repayments without undue strain.

- Transparent Terms and Conditions: Transparency is key when it comes to financial transactions, and EloanWarehouse prides itself on providing clear and transparent terms and conditions to borrowers. Before agreeing to a loan, borrowers are fully informed about the repayment terms, interest rates, fees, and any other pertinent information, ensuring that there are no surprises down the line.

- Excellent Customer Service: EloanWarehouse places a strong emphasis on customer satisfaction, providing exceptional customer service every step of the way. Their knowledgeable and friendly customer support team is available to assist borrowers with any queries or concerns they may have, ensuring a smooth and hassle-free borrowing experience.

- Security and Confidentiality: When dealing with sensitive financial information, security and confidentiality are paramount. EloanWarehouse employs robust security measures to safeguard borrowers' personal and financial data, ensuring that it remains protected at all times.

eLoanWarehouse vs. Payday Loans

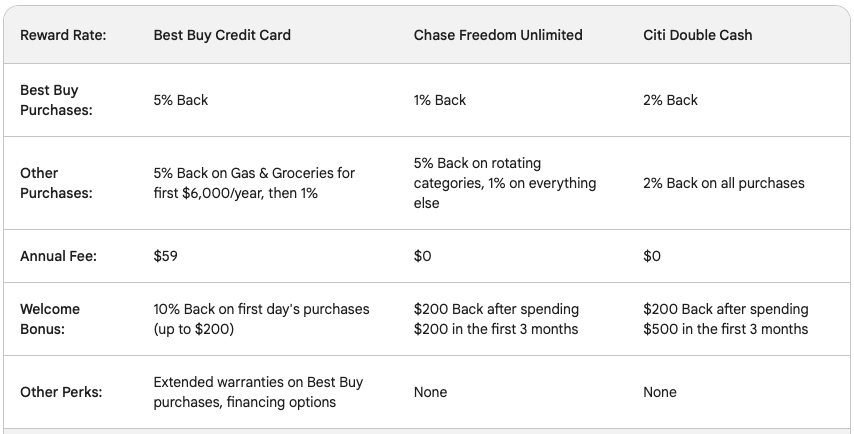

| Feature | eLoanWarehouse | Payday Loans |

| Repayment Term | 6-12 months | 1-2 weeks |

| APR | Varies by state, typically 36%-300% | Up to 400% |

| Loan Amount | Up to $2500 | Typically $500-$1000 |

| Credit Requirements | More flexible, accepts bad credit | Stricter, often require good credit |

| Application Process | Online, fast approval | Often in-person, quick approval |

Benefits of eLoanWarehouse

- Larger loan amounts: Can cover bigger expenses compared to payday loans.

- Lower APRs: Potentially avoid the debt cycle associated with high-interest payday loans.

- Longer repayment terms: Allows for smaller monthly payments, making repayment more manageable.

- Fast and convenient: Apply online and receive funds as soon as one business day.

- Bad credit welcome: Can help build credit history with responsible repayment.

Drawbacks of eLoanWarehouse

- Higher APRs than traditional loans: Still a significant cost compared to banks or credit unions.

- Not available in all states: Check their website for availability in your area.

- Potential for late fees: Missed payments can add up quickly.

The Application Process: How to Secure a Payday Loan with EloanWarehouse

Navigating the application process for a payday loan with EloanWarehouse is a straightforward and efficient experience designed to provide borrowers with quick access to the funds they need. Here's a step-by-step guide on how to secure a payday loan with EloanWarehouse:

- Online Application:

- The first step in obtaining a payday loan from EloanWarehouse is to visit their website and locate the online application portal. This portal is designed to be user-friendly and intuitive, allowing borrowers to easily input their information and initiate the loan application process.

- Provide Personal Information:

- Once you've accessed the online application portal, you'll be prompted to provide some basic personal information. This typically includes details such as your full name, address, contact information, date of birth, and employment status. Be sure to fill out all required fields accurately and honestly to expedite the application process.

- Specify Loan Amount and Term:

- Next, you'll need to specify the amount you wish to borrow and the repayment term that best fits your financial situation. EloanWarehouse offers flexible loan terms, allowing borrowers to choose repayment periods that range from a few days to several weeks, depending on their needs and preferences.

- Verify Income and Employment:

- As part of the application process, EloanWarehouse may require verification of your income and employment status. This is typically done by providing recent pay stubs, bank statements, or other relevant documentation that demonstrates your ability to repay the loan. Rest assured that all information provided is treated with the utmost confidentiality and used solely for the purpose of assessing your loan application.

- Review and Agree to Terms:

- Before finalizing your loan application, take the time to carefully review the terms and conditions provided by EloanWarehouse. Pay close attention to important details such as interest rates, fees, repayment schedule, and any other relevant terms. If everything looks satisfactory and you agree to the terms, you can proceed to submit your application for review.

- Receive Approval and Funds Disbursement:

- Once your application has been submitted, EloanWarehouse will review the information provided and assess your eligibility for a payday loan. If approved, you can expect to receive notification of approval along with details regarding the terms of your loan. Funds are typically disbursed electronically, with many borrowers receiving their money within 24 hours of approval.

- Repay the Loan:

- As per the agreed-upon terms, repay the loan according to the specified schedule. EloanWarehouse offers various repayment methods, including automatic deductions from your bank account or online payments. Be sure to adhere to the repayment schedule to avoid late fees or penalties and maintain a positive borrowing experience.

By following these steps, you can navigate the application process for a payday loan with EloanWarehouse confidently and efficiently, securing the financial assistance you need with ease.

Is eLoanWarehouse Right for You?

eLoanWarehouse can be a viable option if:

- You need a larger loan amount than a payday loan.

- You have bad credit and traditional loans are not an option.

- You can afford the monthly payments with responsible budgeting.

Remember:

- Explore all your options before taking out any loan.

- Compare interest rates and terms from different lenders.

- Only borrow what you can afford to repay on time.

Strategies for Successfully Paying Back Your EloanWarehouse Loan

Effectively managing repayments for your EloanWarehouse payday loan is crucial to maintaining your financial stability and avoiding unnecessary fees or penalties. Here are some strategies to help you successfully pay back your loan:

- Budgeting:

- Create a comprehensive budget that outlines your income, expenses, and debt obligations, including your payday loan from EloanWarehouse. Allocate a portion of your income specifically towards repaying the loan to ensure that you have enough funds set aside each pay period.

- Prioritize Loan Repayment:

- Make repaying your EloanWarehouse loan a top priority to avoid falling behind on payments. Consider cutting back on non-essential expenses or finding additional sources of income to free up more money for loan repayments.

- Set up Automatic Payments:

- Take advantage of EloanWarehouse's automatic payment option, if available, to ensure that your loan repayments are made on time each month. Setting up automatic payments can help you avoid missed payments and late fees while simplifying the repayment process.

- Make Extra Payments:

- If you have the financial means to do so, consider making extra payments towards your EloanWarehouse loan to pay it off more quickly. Even small additional payments can help reduce the principal balance and save you money on interest charges in the long run.

- Communicate with Your Lender:

- If you're experiencing financial hardship or anticipate difficulty making your loan payments, don't hesitate to reach out to EloanWarehouse to discuss your situation. They may be able to offer alternative repayment arrangements or provide assistance to help you manage your loan more effectively.

- Avoid Taking Out Additional Loans:

- Resist the temptation to take out additional payday loans or other high-interest loans while you're still repaying your EloanWarehouse loan. Doing so can lead to a cycle of debt that becomes increasingly difficult to break out of.

- Monitor Your Credit:

- Regularly monitor your credit report to ensure that your EloanWarehouse loan payments are being reported accurately. Timely repayment of your loan can have a positive impact on your credit score, while missed or late payments can damage your creditworthiness.

- Plan for the Future:

- As you work towards paying off your EloanWarehouse loan, start planning for future financial goals and emergencies. Building an emergency fund can help prevent the need for payday loans in the future and provide a safety net for unexpected expenses.

By implementing these strategies and staying committed to responsible financial management, you can successfully repay your EloanWarehouse payday loan and take control of your financial future.

In conclusion, payday loans EloanWarehouse serve as a valuable resource for individuals in need of immediate financial assistance. With their quick approval times, accessibility, and flexible repayment terms, EloanWarehouse provides a convenient solution for addressing short-term cash needs. However, borrowers should approach these loans with caution, mindful of the associated costs and potential risks involved. By understanding both the benefits and drawbacks of payday loans EloanWarehouse, borrowers can make informed decisions about their financial well-being.

Frequently Asked Questions

A payday loan from EloanWarehouse is a short-term, small-dollar loan designed to provide quick financial assistance to individuals facing unexpected expenses or emergencies. These loans are typically repaid with the borrower's next paycheck.

To apply for a payday loan at EloanWarehouse, visit their website and fill out the online application form. You will need to provide personal and financial information, and the approval process is generally quick.

Eligibility requirements may vary, but typically, applicants need to be at least 18 years old, have a regular source of income, and provide proof of identification. EloanWarehouse may also consider factors like credit history.

Loan amounts vary, but payday loans are usually small-dollar amounts, often ranging from a few hundred to a couple of thousand dollars, depending on the borrower's income and other factors.

Payday loans from EloanWarehouse are short-term loans, and the repayment period is typically tied to the borrower's next payday. This means the loan is usually repaid within a few weeks.

EloanWarehouse will provide details about fees and interest rates during the application process. Payday loans often have higher interest rates and fees compared to traditional loans, so it's essential to understand the terms before accepting the loan.

EloanWarehouse may offer extensions or rollovers, but these options usually come with additional fees. It's crucial to communicate with them if you're unable to make the payment on time to explore available alternatives.

Defaulting on a payday loan can result in additional fees, increased interest rates, and collection actions. EloanWarehouse may report the default to credit bureaus, impacting your credit score.

EloanWarehouse may consider applicants with bad credit, as the primary eligibility criteria often involve having a regular source of income. However, the terms and interest rates may be higher for individuals with lower credit scores.

The speed of fund disbursement varies, but payday loans are known for their quick approval and funding processes. EloanWarehouse aims to provide funds as soon as possible after approval, often within one business day.